kentucky lottery tax calculator

If you win the 10000 prize you need to pay the federal tax 25 of the whole amount. How to Use the Lottery Tax Calculator for Lump-Sum Payments.

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

That means that on a 20 million ticket youd pay 5 million to the federal government and an additional 12 million to the state of Kentucky.

. To use the calculator select your filing status and state. Second you need to pay state tax and other local taxes. Kentucky Capital Gains Tax.

The calculator will display the taxes owed and the net jackpot what you take home after taxes. Kentucky pales in comparison to the federal lottery tax rate which is an astounding 25 percent on all winnings over 5000. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

You can find out tax payments for both annuity and cash lump sum options. State New York Jackpot value. After you are done check out our guide on the best lottery prediction software for tools that will help increase your odds of winning - significantly.

How much tax do you pay on a 10000 lottery ticket. Lottery winnings over 600 in Kentucky are subject to both state and federal taxes. The table below shows the payout schedule for a jackpot of 20000000 for a ticket purchased in Kentucky including taxes withheld.

Just enter the amount you have won and select your state. For most counties and cities in the Bluegrass State this is a percentage of taxpayers. Lottery taxes are anything but simple the exact amount you have to pay depends on the size of the jackpot the statecity you live in the state you bought the ticket in and a few other factors.

The Kentucky Lottery announced during a board of directors meeting last week that its sales are at an all-time high the largest in the organizations 32-year history at 13. Add the total value of the prize and keep the length as 1 as in one single payment. Federal and state taxes are withheld for all lottery prizes over 5000.

Our calculator has been specially developed in order to provide the users of the calculator with not only. Use the tax calculator below to calculate how much of your payout you would be taking home following the respective federal and state taxes that are deducted. A lottery payout calculator can help you find the lump sum or annuity payout of your lottery winnings based on the advertised jackpot amount multiplier and the total number of winners in each state.

In 2018 Kentucky legislators raised the cigarette tax by 50 cents bringing it up to 110 per pack of 20. You can compute for your net lottery winnings by subtracting federal 25-37 state taxes 0-882 plus applicable local taxes from the advertised prize amount. Current Mega Millions Jackpot Friday Aug 05 2022 36000000 Federal Tax Withholding 24 Select your filing status.

See our Tax Information section for more details. Add the total tax rate of the lottery country and calculate. Weve created this calculator to help you give an estimate.

In general lottery annuity payments consist of an initial payment and a number of gradually increasing. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. The tax rate is the same no matter what filing status you use.

That means they are subject to the full income tax at a rate of 5. Annuity-based lottery payouts work the same way as common immediate annuitiesMore specifically lottery annuity payments are a form of structured settlement where the scheduled payments are 100 percent guaranteed by the lottery commission. To use our Powerball calculator just type in the advertised jackpot amount and select your state and the calculator will do the rest.

This will display 2 figures the tax paid on your gambling winnings and the amount you can keep from your gambling winnings. Finally you might owe more at tax time if you fall into one of the higher tax brackets. This is still below the national average.

Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes. A lottery payout calculator can also calculate how much tax youll pay on your lottery winnings using current tax laws in each state. Capital gains are taxed as regular income in Kentucky.

Depending on where you live you may forgo this step. The scratch-off lottery tax calculator lottery tax calculator for Mega Millions and lottery tax calculator for Powerball all receive the same results. Do not forget to use the lottery tax calculator for both annuity and lump-sum payments.

Kentucky imposes a flat income tax of 5. Select your state on the calculator below select your relationship status add in your taxable income enter the amount you won and press calculate. Do you pay taxes on 1000 lottery winnings.

How to Calculate Taxes on Lottery Winnings The federal tax rate for anything equating to more than 300 times your bet -- as well as any amount surpassing 5000 is 24 percent. How much tax would you pay on a 100000000 lottery prize. Current Lottery Jackpot US 20000000 Current Lottery Jackpot.

For prizes between 600 and 5000 the Kentucky Lottery doesnt withhold any taxes but issues the winner a W2 tax form. Please note the amounts shown are very close approximations to the amount a jackpot annuity winner would. Overview of Kentucky Taxes.

Then select if this was the jackpot or not and if it was then choose whether you took the annuity option or cash lump sum.

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

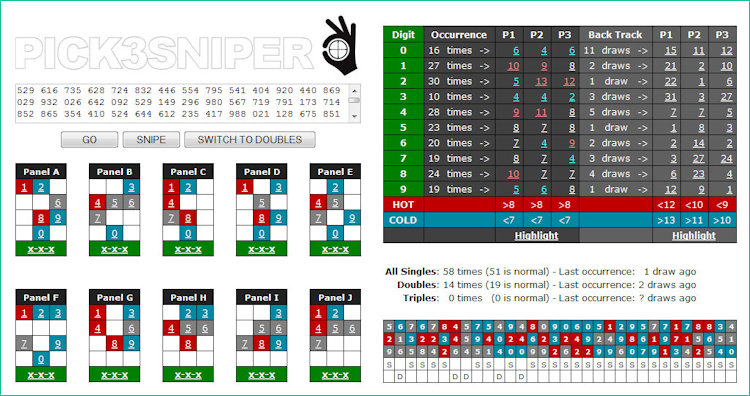

Ultimate Pick 3 Strategy Guide

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator For Usa Onlinelottosites Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Virginia Lottery Review Odds Reviews By Compare The Lotto

Free Tax Preparation Services In Bakersfield

Pennsylvania Lottery Review Odds Reviews By Compare The Lotto

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact

Mega Millions Payout Calculator Charts For After Taxes Heavy Com

How Much Money Will You Get After Taxes If You Win The Mega Millions Jackpot Wftv

Pennsylvania Lottery Review Odds Reviews By Compare The Lotto

Best Lottery Tax Calculator Lotto Lump Sum Annuity Payout

Virginia Lottery Review Odds Reviews By Compare The Lotto

Lottery Tax Calculator For Usa Onlinelottosites Com

Lottery Tax Calculator How Lottery Winnings Are Taxed Taxact